Things at Sierra Monitor Corporation may look a bit different. But rest assured, our innovative spirit, the quality products that you depend on and that same level of exceptional service you have come to expect, remains unchanged.

FieldServer Automation Gateways

The FieldServer suite of automation gateway products is quietly at work on site or in the cloud at over 100,000 locations around the world. The comfort and safety of millions of people depends daily on FieldServer devices as they enter corporate, educational, medical, entertainment, industrial and other facilities in major cities and at some of the most remote locations on earth.

SMC Gas Detection

SMC detection solutions address the facilities safety segment. Our SMC branded controllers, sensor modules, and software are used by safety managers to protect facility personnel and assets across thousands of facilities such as natural gas vehicle fueling and maintenance stations, wastewater treatment plants, parking garages, and underground telephone vaults.

Featured Products

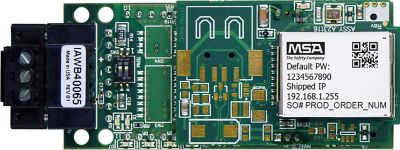

FieldServer

+1 408 262-6611 7:00 AM to 5:00 PM (Pacific / UCT-8:00) +31 33 808 0590 (FST) smc-support.emea@msasafety.com 8:00 AM to 5:00 PM (UTC+2:00)Customer Support Tools

Software Downloads

Access software downloads here Protocols

Access Protocols Here Resources

Application Notes

ENOTEs

Certifications

Documentation

Case Studies

Contact Us

NORTH AMERICA

Phone

For Product Support

Sales

Orders

Hours

Monday to FridayEMEA and APAC

Phone

+971-50-550-3933 (Gas)For Product Support

Sales

Orders

Hours

Monday to Friday